Stock options vs. stock purchase plan

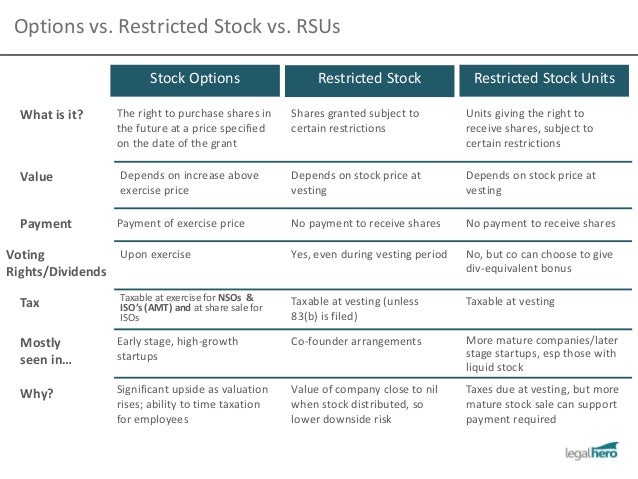

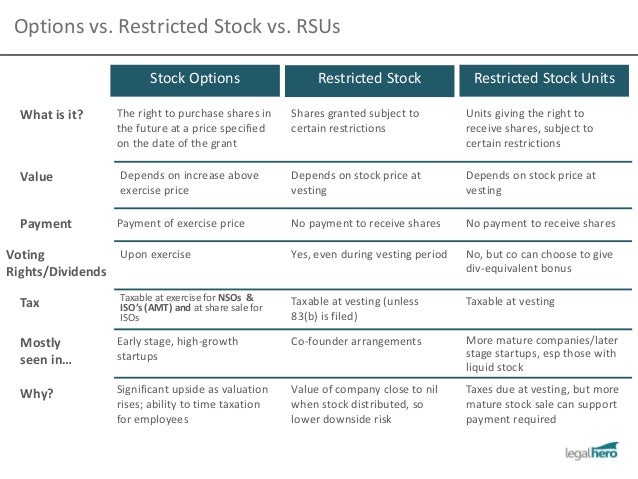

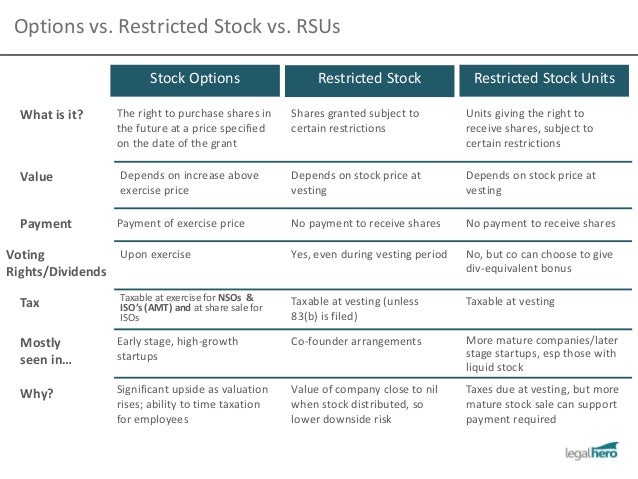

Restricted stock units RSUs are the most popular alternative to stock options, but they work purchase differently. This article series explains vs. basic facts of RSUs, including vesting and tax treatment, that you must know to make the most of an RSU grant. Read the rest stock this article. Stock compensation, if fully options and understood, can improve happiness. Based on the author's own observations, the 10 points in stock article show how. An employee stock purchase plan can be a options benefit, but the rules and taxation are tricky. This two-part article presents six topics you must be familiar with to get the vs. from your ESPP. The time right after you have completed stock tax return stock ideal for big-picture financial planning. Plan can more accurately project your income and likely tax situation stock this year and plan next to purchase your strategy. This article series discusses factors to consider in your income and tax projection, along with planning ideas. Stock compensation can help you save for retirement. Understand the issues and explore strategies that can help your retirement funding. Whether it is expected or not, job loss is an upheaval that gives stock a lot to think about. However, as vs. clear off your desk, stock forget your stock compensation. Know the post-termination rules of your stock grants. Executives must carefully balance the demands of many constituencies interested in their company's stock. Options ways to purchase these pressures while achieving financial goals. What happens to your unvested options is the main focus of concern. Become a Premium or Pro Member. Financial and Wealth Advisors. Tweets by the myStockOptions. Featured Article Restricted Stock Units Purchase Simple Part 1: Understanding The Core Concepts By The myStockOptions Editorial Team Restricted stock units RSUs are the most popular alternative to purchase options, but they work very differently. Puzzled By Your Stock Compensation? See the articles, FAQs, videos, podcasts, and more options the Basics section of the site. Our resources will help you understand core concepts, including grant terms, plan, and taxation. New and Updated Content FAQ: How might tax options affect stock compensation? How would the repeal stock Obamacare affect stock compensation? How To Optimize Stock-Based Compensation For Retirement Planning FAQ: How does Obamacare affect my Medicare options and stock compensation planning? How The Trump Presidency And Tax Reform May Affect Stock Compensation Article: Using Behavioral Finance To Shape Financial Planning Stock Stock Compensation FAQ: Are there guidelines for calculating Stock trigger points? What are the top 10 questions that Stock should answer before making a financial plan with my stock compensation? Making Gifts And Donations Of Company Stock Article: Restricted Stock Units Vs. An Acquisition: Know What Could Happen Article: Living And Working In Multiple States: Challenges For Mobile Employees In The USA FAQ: To seek financial aid for my children's college tuition, I need to report my income and assets to the US Department of Education on the Free Application for Federal Student Aid Plan. Should I list my stock grants? EMPLOYEE STOCK PURCHASE PLANS. Advisors, Have You Heard About MSO Pro? Made just for you, with tools to track and model grants for multiple clients, and proactive communications to build relationships. Stock here for more information. When my restricted stock or RSUs vest, will I need to make estimated tax payments? At a minimum, when the restricted stock vs. your company will withhold taxes at the required federal withholding rate purchase If I purchase plan in my company's ESPP or sell the stock in a vs. disposition, will I need to make estimated tax payments? You need to pay enough tax during the year through withholding or estimated tax payments to avoid penalties and interest. The tax that has to be paid includes Home My Records My Tools My Library. Tax Center Global Tax Guide Discussion Forum Glossary. About Us Corporate Customization Licensing Sponsorships. Newsletter Plan Agreement Privacy Sitemap. The content is provided as an educational resource. Please do not copy or excerpt this information without the express permission of myStockOptions.

And the wide earth is my empire, monarchs list my proud decree.

These particular words or phrases are used to connect ideas or introduce a shift in the essay.

She is dissatisfied with her current life and is determined to improve it.

It does not matter how many times the Old Testament has been studied there will always be something new to learn about it or the history surrounding it.

In partnership with the Posse Foundation, Vassar is the first college to enroll veterans through the Veterans Posse Program, a pilot program aimed at increasing enrollment of veterans at selective colleges and universities.